- 25 Mar, 2021

Over three decades of cumulative experience delivering exceptional Audit, Assurance, Taxation, Advisory and Consulting Services.

Loading

Over three decades of cumulative experience delivering exceptional Audit, Assurance, Taxation, Advisory and Consulting Services.

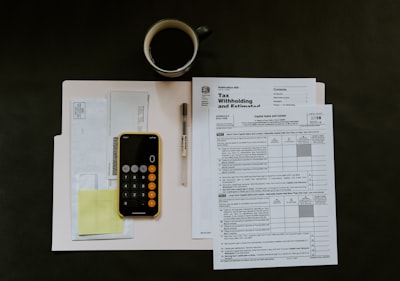

Our tax services help organizations comply confidently with FIRS and state tax requirements while managing risks and optimizing cash flow. We support corporate income tax, VAT, WHT, PAYE, and industry-specific tax obligations.

AOPS combines technical expertise with practical advice so finance teams can meet deadlines, respond to audits, and plan sustainably.

From routine filings to complex advisory, we provide end-to-end tax support tailored to your size, sector, and regulatory exposure.

Tax rules evolve quickly, and documentation expectations are increasing. We help you build strong records, manage disputes, and maintain compliance without disrupting operations.